CyberSource for Credit Card Payment Processing Gateway

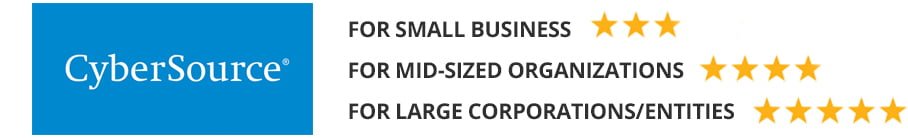

CyberSource is a global payment gateway. They were first established as an online payment/fraud management service in 1994 and acquired Authorize.Net in 2007. CyberSource was then able to focus their efforts on large enterprises while refocusing Authorize.net on the needs of small- to medium-sized businesses.

This acquisition greatly expanded their reach as a company, and they now service small businesses and large enterprises throughout the world. This outstanding growth resulted in a buy out by Visa Inc in 2010.

It’s no wonder that CyberSource, being as large as it is, has been able to develop detailed solutions for merchants concerning their payment processing needs. Many payment gateway companies act as just that, a payment gateway, offering limited tools for merchants. CyberSource acts as a gateway while providing a vast amount of fraud support tools and payment processing reporting solutions.

Verisave has worked with CyberSource on behalf of hundreds of clients. We’re confident that our in-depth knowledge of this payment gateway company can be an advantage to merchants currently using their services or looking to enroll in their services. If you’d like to obtain savings on your merchant account then contact Verisave today.

Products & Services Offered

CyberSource offers an impressive selection of services, all regarding payment processing or the management of payment processing.

First and foremost, they act as a payment gateway for all of your credit card payments from customers. With CyberSource, you can accept payments from all major credit card companies including Visa, Mastercard, American Express, Discover, and more. With their global reach, you can accept payments from a wide variety of foreign credit card companies as well. You can also accept payment across virtually all payment platforms from numerous processors, mobile apps, and more – worldwide.

Concerning credit card payment processing, CyberSource offers the following services:

- Integrated Visa Checkout

- Apple Pay

- Alipay

- Cross-Channel Payments

- Gateway and Processing Connections

- Payment Card Acceptance

- Mobile Payments

- Direct Debits and Bank Transfers

- Global Tax Calculation Solution

- Recurring Billing

- CyberSource Payouts

Concerning credit card payment fraud protection, CyberSource offers the following services:

- Secure Acceptance & Token Management Service

- Decision Manager

- Decision Manager Replay

- Rules Suggestion Engine

- Managed Risk Services

- Account Takeover Protection

- Rules-Based Payer Authentication

- Fraud Alert

- Delivery Address Verification

- Export Compliance

CyberSource offers the following services for credit card payment processing management:

- Universal Payment Management Platform

- Merchant Account Reporting Tools

- Reconciliation Reports

- Professional Services

- Global Support

MERCHANT PAYMENT PROCESSING SOLUTIONS

CYBERSOURCE INTEGRATED VISA CHECKOUT – CyberSource offers a very simple checkout process. Once the customer has enrolled in the Visa Checkout program,

Checkout is much faster with no redirects. This has proven to lower shopping cart abandonment. It is secure and merchants do not have to store sensitive customer information.

CYBERSOURCE APPLE PAY – Customers can make in-app payments from their iPhone using credit and debit cards from Visa, MasterCard, and American Express. This feature is currently available only in the United States.

CYBERSOURCE ACCESS TO ALIPAY – Alipay is an electronic payment system and third-party online payment platform giving you access to sales in China. Alipay provides domestic and cross-border payment services through partnerships with hundreds of financial institutions in China, as well as Visa and MasterCard.

CYBERSOURCE CROSS-CHANNEL PAYMENTS – Accept credit card payments via the web, mobile device, and call center.

CYBERSOURCE GATEWAY & PROCESSING CONNECTIONS – Transact payments in over 190 countries and territories using over 40 currencies.

CYBERSOURCE PAYMENT CARD ACCEPTANCE – Cybersource accepts a wide range of regional and universal cards.

CYBERSOURCE MOBILE PAYMENTS – Allow for monetary transactions via mobile devices for your customers. Cybersource supports the use of Alipay, Apple Pay®, Masterpass, Samsung Pay® (in-app and on the web), PayEase, PayPal®, Visa Checkout® and Google PayTM.

CYBERSOURCE DIRECT DEBITS & TRANSFERS – You can offer your customers the option to pay via direct debit (similar to an eCheck) for subscription and recurring payments. This is often one of the least expensive options for payment acceptance for merchants.

CYBERSOURCE GLOBAL TAX CALCULATION SOLUTION – Calculate sales, use, and Value Added Tax (VAT) in real time. Identify tax jurisdictions by address. Assesses tax by line item rather than total amount for greater accuracy. Accommodate maximum tax rates, rate overrides, and exemptions. This service covers 14,000 tax jurisdictions in the United States and

VAT in 30 countries.

CYBERSOURCE RECURRING BILLING – Offer recurring, subscription, and installment payments to customers using all major cards (Visa, MasterCard, American Express) and regional cards (including Maestro, ATM/debit cards, Aura, and Hipercard) in multiple currencies.

Data is stored in PCI DSS compliant datacenters.

CYBERSOURCE PAYOUTS – Send refunds to customers in minutes via Visa Direct and Mastercard Send.

CREDIT CARD PAYMENT FRAUD PROTECTION SOLUTIONS

CYBERSOURCE SECURE ACCEPTANCE & TOKEN MANAGEMENT SERVICE – Secured acceptance of payments via web and mobile browsers. No payment data is stored on your system.

CYBERSOURCE DECISION MANAGER – This fraud management solution uses several machine learning methods to generate risk scores. It allows you to automatically screen and sort orders based on your business rules using effective conventional static models and works with any payment platform.

CYBERSOURCE DECISION MANAGER REPLAY – Allows you to quantify fraud strategies in real-time prior to activating in the live production environment, test various ‘what-if’ rules profiles against your own historical data, and produce real-time reports of likely changes to the transaction disposition and fraud rates.

CYBERSOURCE RULES SUGGESTIONS ENGINE – A fraud tool that suggests new fraud rules to consider implementing and testing.

CYBERSOURCE MANAGED RISK SERVICES – Be informed of consulting/monitoring opportunities, outsourcing options, and new fraud trends. Build fraud strategies when considering expanding into new geographies, markets, and channels, including mobile.

CYBERSOURCE ACCOUNT TAKEOVER PROTECTION – This fraud protection tool allows you to monitor customer account creation, updates, and login for suspicious activity.

CYBERSOURCE RULES-BASED PAYER AUTHENTICATION – Select from different options for payer authentication.

CYBERSOURCE LOYALTY FRAUD MANAGEMENT – This fraud prevention tool allows you to watch for potential fraud on customer accounts starting at the login point and going through the entire check out and payment process.

CYBERSOURCE FRAUD ALERT – You can quickly receive notifications from customers of fraud to stop shipments and prevent chargebacks.

CYBERSOURCE DELIVERY ADDRESS VERIFICATION – Save on shipping errors by accessing this tool to verify all shipping addresses.

CYBERSOURCE EXPORT COMPLIANCE – Be sure of compliance of U.S. Government export regulations.

CREDIT CARD PAYMENT PROCESSING MANAGEMENT SOLUTIONS

CYBERSOURCE UNIVERSAL PAYMENT MANAGEMENT PLATFORM – CyberSource is a very large company with an equal sized customer base. They have been able to develop an entire platform for credit card payment processing to help businesses manage their revenue. CyberSource’s universal payment management platform is specially designed for large enterprises to handle every aspect of the credit card payment process including the acceptance of payments, security of information, fraud management. They provide tools for managing these services with a customizable console/control panel for viewing credit card processing reports and analytics.

CYBERSOURCE MERCHANT ACCOUNT REPORTING TOOLS – With CyberSource merchant account reports, you see reports of payment summary information by card type, transaction-level details for purchases, refunds and chargebacks, fee summaries with certain variable fees included at the transaction-level, chargeback detail reports, bank account/funding reports, access from the CyberSource online Business Center console, programmatic access to reports in XML, CSV, PDF and Excel formats, access to 16 months of historical summary information and 180 days of transaction level detail, and more.

CYBERSOURCE RECONCILIATION REPORTS – View reports showing amount and count of payment transactions by payment, method, and currency; View details of payment transactions submitted to the processor.

CYBERSOURCE PROFESSIONAL SERVICES – You can also opt for CyberSource services that support your business with consulting and design. Use their implementation services for easier integration.

CYBERSOURCE GLOBAL SUPPORT – Receive support through multiple channels and languages for global business and payment management.

Try speaking with Verisave before enrolling in CyberSource services. Having worked with hundreds of companies processing credit payments through CyberSource’s gateway, we can help you save money. If there is a better gateway option out there for your company, we’ll let you know. Give us a call before making long-term commitments to any credit card payment gateway company.

UI/System Integration

Online reviews of CyberSource describe the implementation of CyberSource solutions as being very simple and easy to manage. Thanks to their excellent customer support and years of product development, they have created a very user-friendly, intuitive system. Now that they are working under Visa, we are anticipating continual growth and positive changes to their software and overall payment processing systems.

How Much Will You Be Paying For CyberSource Services?

CyberSource, like many credit card payment gateway companies, does not disclose their pricing on their website. For quotes, you can call and speak with a sales representative. Often times these quotes can be negotiated so never settle for the first number offered.

When speaking with CyberSource, they will collect information from you about your specific business. CyberSource can use a tiered pricing model. Your quote for fees will be based on a number of factors including:

- Your monthly credit card processing volume

- The CyberSource services you would like access to

- Your specific industry

- Your ability to fairly negotiate the proposed fees and terms

Because Verisave has worked with CyberSource customers across all different industries, we offer clients a leg up on saving money with them..

Consider Your Desired Contract Length

While CyberSource does not share this information on their website, you can speak with a sales representative to find out more. Many of their fees and contract terms can be negotiated. Few customer reviews mention anything having to do with contract lengths. This is likely because that type of audience is working with smaller business while CyberSource is specifically used by large corporations. Their payment gateway services start near $500 per month, so companies paying for their services are likely not writing reviews online but instead dealing directly with the company.

CyberSource contracts start at a minimum of 1 year. You can increase contract length to 2 years, 3 years, and so on. There is a small amount of variance in regards to this aspect. As with any contract of these lengths, early termination will have fees associated with it. But these fees will vary based on your contract. The benefit of a longer contract with CyberSource is that they can sometimes decrease the overall cost for services.

If you are looking to save money on credit card fees or restructure your merchant services in general, then speak with Verisave’s merchant services experts. Customers achieve an average savings of 25%-35% in credit card processing fees and other merchant related expenses after a free audit from Verisave.

Speaking With CyberSource Sales and Customer Service Reps

Researching CyberSource Merchant Services – CyberSource has an excellent website that gives lots of detail about the specific tools they offer to merchants for payment processing. They do lack information about pricing. This is unfortunate, but also understandable. To get even an idea of how much their services will cost, you’ll need to speak with a sales representative.

Your initial call will result in a quote for services, once you’ve provided a slew of personal information. It’s likely to be vague, leaving you with questions about specifics as you continue your research. A majority of the complaints about CyberSource seem to revolve around a lack of transparency involving early termination. This can be avoided and does not have to be a frustration for all customers.

Contacting CyberSource Customer Support – CyberSource has excellent online resources for customer support. Instead of calling their support line (which you can do), you can usually find answers to questions in their library of whitepapers, data sheets, and helpful articles. They have different support channels for merchants, merchant account administrators, and technicians. You can also reach support by email. This goes for current and potential customers.

Online Reviews of CyberSource

Keep in mind that CyberSource is now a part of Visa Inc. Many changes have been made in the last few years to eradicate bugs, improve transparency, and simplify their software solutions. Reviews on trustworthy review sites are often not recent and may not reflect the current state of CyberSource.

A majority of the complaints online about CyberSource have to do with their relationship to Authorize.Net. A clear understanding of your contract can help you to avoid frustrations other customers have felt using their services. This is another strong suit for clients who choose to work with merchant account auditors at Verisave. Our expertise in working with these two companies can help you to avoid any lack of transparency provided by CyberSource or Authoriz.net as you are enrolling in their services or choosing to terminate.

VERISAVE MERCHANT SERVICES REVIEW

CyberSource for Credit Card Payment Processing

If you are one of many CyberSource customers using their payment gateway and payment management solutions, you could be overpaying on credit card processing fees without realizing. We have found after a thorough review of company merchant account statements, many businesses are paying higher rates and fees than necessary. We know this by running their numbers against proprietary data we’ve collected from working with over 500 companies processing varying volumes of credit card payments each month.

Submit your most recent merchant account statement today to see if you could benefit from working with account auditing experts at Verisave. After years of working in this industry, we have developed proven strategies for reducing merchant account fees for our clients. When implemented in a specific order, we can maximize your savings potential. We find and acquire an average of 25% to 35% in savings for our clients by reducing their monthly processing fees, eliminating unnecessary account fees, and obtaining lower processing rates.

Considering using CyberSource for your payment gateway provider? Speak with Verisave first to see what we can do to obtain savings for you.