First Data for Credit Card Payment Processing

First Data is a massive credit card processing company, with a client base of approximately 6 million customers across the globe. They were first established in 1969 and since then, have grown considerable amounts. With the size, reach, and resources available to this company, they have developed effective tools to help business owners manage their companies.

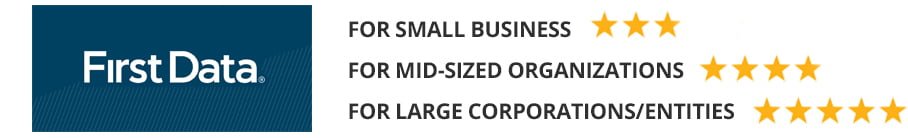

First Data caters to small and large business alike. With their many available tools and services, businesses can customize their contracts and packages with First Data to fit their specific needs. This type of customization works for many, but it’s important to remember that First Data is not a one-size-fits-all processing company – though they aim to be. Depending on a number of factors, your business could benefit or lose from working with First Data.

Working with merchant account experts at Verisave can help you to determine whether or not First Data is the best option for the lowest credit card processing. We look at your credit card processing volumes and other merchant account details to identify savings strategies that can be applied to your account.

Products & Services Offered

First Data offers a wide (and sometimes overwhelming) array of services on top of credit card payment processing. We will break down these services below. However, access to these services can be managed in two ways: signing up with First Data directly, or obtaining First Data services through an independent sales organization (ISO). Signing up with First Data directly, though not always the most cost-effective option for some business’, will give you more access to the majority of their features. If you were to sign up for First Data processing through an ISO, you may have limited First Data services to choose from. If there are specific First Data services you’re interested in receiving, see if your ISO is able to offer these services to you before signing contracts.

First Data offers the following credit card processing services:

- POS Systems

- Credit Card Terminals

- Merchant Accounts

- Payment Gateway

- Clover Check Acceptance

- TeleCheck Solutions

- Electronic Check Acceptance

- Internet Check Acceptance

- Connect Pay

- Payeezy Gateway

- Credit/Debit/EBT Acceptance

FIRST DATA POS SYSTEMS – First Data has recently launched a new line of POS systems called “Clover”. They do offer more traditional POS systems but you have to call for details as they do not talk about them on their website.

[su_row class=”s-row”][su_column size=”1/2″]Clover Mini [/su_column]

[/su_column]

[su_column size=”1/2″]Clover Flex [/su_column][/su_row]

[/su_column][/su_row]

[su_row class=”s-row”][su_column size=”1/2″]Clover Station [/su_column]

[/su_column]

[su_column size=”1/2″]Clover Go [/su_column][/su_row]

[/su_column][/su_row]

FIRST DATA TERMINAL OPTIONS – Besides the newly released Clover POS options, there are more traditional terminal options offered by First Data. These options include:

- Virtual Terminal Software

- Mobile Device POS

- Check scanners

- Touchscreens

- FD35

FIRST DATA CLOVER CHECK ACCEPTANCE – This is First Data’s check acceptance solution for small businesses. Process check and ACH payments with electronic funding and guarantees against chargebacks.

FIRST DATA MERCHANT ACCOUNTS – Because First Data is a direct processor, you’ll go through them for your merchant account AND processing which eliminates some hassle found with merchants who have one company handling their merchant account and another company handling their payment processing.

FIRST DATA PAYMENT GATEWAY – First and foremost, First Data is a payment processor. There are advantages to using a payment processor of this size – having one company manage your processing and merchant account, for example. However, there are advantages to using a smaller processor, that allow for other gateway options and possibly better pricing.

FIRST DATA CHECK PAYMENT PROCESSING – There are multiple tools offered by First Data for processing check payments, including:

- Clover check acceptance

- Telecheck solutions

- Internet check acceptance

- Electronic check acceptance

FIRST DATA CONNECT PAY – This is a tool offered by First Data that allows customers to set up recurring payments.

FIRST DATA PAYEEZY GATEWAY – This is First Data’s online payment gateway for eCommerce sites. It works with 70+ online shopping carts and is trustworthy/secure for shoppers.

FIRST DATA CREDIT/DEBIT/EBT ACCEPTANCE – First Data is capable of processing all major US credit cards.

First Data offers the following security services for payment processing:

- Clover Security

- EMV Enablement

- Encryption and Tokenization

- Fraud Detection

- PCI Compliance

FIRST DATA CLOVER SECURITY – The is First Data’s small business solution for payment processing security. With these services, you receive an available liability waiver for card association fines and expenses of up to $100,000 per location (up to 5 locations) in the event of a data breach. Fraud and security monitoring detect possible tampering. Specialized helplines for security questions. EMV chip card payment acceptance hardware.

FIRST DATA EMV ENABLEMENT – These tools help assess what a smart card payment enablement plan would look like for upgrading all consumer-facing POS devices. It provides a comprehensive payments security plan to identify ways you can reduce fraud and data theft risks. Accept cards with embedded computer chips that interact with an EMV™-enabled point-of-sale terminal to validate the card.

FIRST DATA ENCRYPTION AND TOKENIZATION – First Data secures information using combined public/private encryption and tokenization to protect data. You can also have full access to the format-preserving tokenized card data for business and marketing uses.

FIRST DATA FRAUD DETECTION SOLUTIONS – First Data utilizes machine learning based customizable rules for fraud detection. Creates analytics reports for your dashboard.

FIRST DATA PCI COMPLIANCE – Using First Data as your processor makes your business compliant with all industry standards including:

- Cardholder Information Security Program (CISP)

- Payment Card Industry (PCI)

- Data Security Standard (DSS)

First Data offers additional services for merchants and business management:

- Clover Online

- Clover Insights

- Clover Rewards

- Clover Gift Cards

FIRST DATA CLOVER ONLINE – First Data has developed a website building tool to help retailers sell their inventory to an online market. The website and your POS system work together. With their website builder, you also receive data encryption for site security and technical support via their support center.

FIRST DATA CLOVER INSIGHTS – This is First Data’s analytics reporting software for small business. View trends and benchmarking to track your business’ performance over time, heat maps that show where your customers live and shop, and weather breakdowns that track how your business performs in different conditions. View analytical reports to see customer behavior and buying habits.

FIRST DATA CLOVER REWARDS – This tool was created to help business owners with marketing and digital loyalty programs for customer retention. They provide digital graphics and marketing tools as well as performance analytics to view customer preferences and popular perks.

FIRST DATA CLOVER GIFT CARDS – You can provide customers with digital or physical gift cards.

Try speaking with Verisave before enrolling in First Data services. Verisave merchant account experts have worked with many companies using First Data as their credit card payment processor and gateway provider. Based on our experience with this company, we can help you save money that merchants cannot ordinarily obtain on their own.

How Much Will You Be Paying For First Data Services?

First Data rates differ from customer to customer, based on a number of factors including:

- Monthly credit card processing volume

- Industry

- Location

- Contract negotiations

They do not disclose fees for services on their website because each customer has the potential to negotiate a different rate. Also, processing rates are not set in stone. They can increase and decrease throughout the year. There are a few things to keep in mind when looking to enroll in First Data services. If you are to sign up directly through First Data for their services, you will likely pay higher rates than if you were to sign up through an ISO/third party retailer. Smaller ISO’s can usually offer lower rates and fees to their customers.

You will also pay less over time for First Data services if you opt to buy your POS system instead of leasing. Leasing the POS terminal and other equipment almost always result in high markups.

We will help you to know if you would be better signing up with First Data through a retailer or if you should go through First Data directly. Because First Data is primarily catered to large business entities, small to medium-sized business’ can usually find better rates for services through an ISO (independent sales organization) offering First Data processing.

Consider Your Desired Contract Length

You can definitely negotiate the length of your contract with First Data, making them a great option for anyone looking to avoid long term contracts for credit card processing. If they are unwilling to offer you the contract length you desire, then opt for an ISO that resells First Data services. You can find many that offer month-to-month contracts.

If you do enroll directly with First Data, beware of their automatic renewal clause. You may be able to have this language removed from your contract. But if not, be sure to know how to cancel automatic renewal to avoid paying early termination fees.

You will pay an early termination fee for canceling First Data services before your contract is expired. This usually includes your monthly minimum, your monthly customer service fee, and you monthly account fee for each month remaining on your contract.

If you are ready to save money in credit card processing or other merchant account services, then speak with Verisave’s merchant services experts. Customers achieve an average savings of 25%-35% in credit card processing fees and other merchant related expenses after a free audit from Verisave.

Speaking With First Data Sales and Customer Service Reps

Researching First Data Merchant Services – Obviously, First Data is a very large company. Which is why it might be surprising that a majority of their website (which is also large) is marketing jargon. Researching their products and services proves to be a bit difficult because of the lack of technical information they provide on their site. Lots of their service explanations include links to view their brochures (printed marketing material) but they still lack in easy-to-find technical specs. Nowhere mentions pricing or contract length. If you’re attempting to research their POS systems, that will be a challenge as well. The only POS systems they promote directly on their site is the new Clover series. However, they reference “other” options which clue you into the existence of more traditional POS systems. To get more detailed information about pricing, services, contract length, etc. you must call and speak to a representative.

Contacting First Data Customer Support – First Data offers lots of online support. If you’re willing to do a bit of reading, you can usually answer your own questions, thanks to their resources, without having to wait on hold for a customer service rep. You can also use their live chat feature while browsing their help library to ask questions and speak with a customer service rep. But if you prefer calling in, First Data has a call line for customer support. First Data generally doesn’t receive complaints about their customer support which is a great sign for such a large company.

Online Reviews of First Data

We don’t necessarily give much weight to negative online reviews. As First Data has a customer base of nearly 6 million merchants, a few negative complaints hardly represents the whole picture.

What you will find in the reviews online revolve mostly around three issues: withheld funds and account terminations, excessive account fees, and enhanced billback. All of these issues have one major thing in common…

Merchants did not have a full understanding of their agreement with First Data when they signed up for services. Verisave can help you avoid the frustrations found in First Data reviews online. Our experience with First Data merchants has helped us to understand their standard contract elements and more.

VERISAVE MERCHANT SERVICES REVIEW

First Data for Credit Card Payment Processing

Being such a large company, First Data itself is geared more towards large enterprise than small businesses. If you’re a small business looking for a credit card payment processor, try researching companies more suitable for your monthly credit card processing volume like Authorize.net.

Large companies are more suited to the pricing models and contract lengths offered by First Data. Even so, you can easily be overpaying for your merchant services without the help of credit card processing auditors at Verisave. We find that are customers are over paying an average of 25% to 35% for their monthly merchant account, processing, and other credit card payment services.

Submit your most recent merchant account statement today to see if you could benefit from working with account auditing experts at Verisave. After years of working in this industry, we have developed proven strategies for reducing merchant account fees for our clients. When implemented in a specific order, we can maximize your savings potential.

Currently using First Data as your credit card payment processor? Speak with Verisave to see what we can do to save you money on your merchant account.