Authroize.Net for Credit Card Payment Processing

Many eCommerce merchants use Authorize.Net for their credit card payment gateway solutions. While they do offer a package that gives users a merchant account, this merchant account is run by a third-party processor.

Access to Authorize.Net payment gateway can be achieved by enrolling via your current processor or by going through a processor who is already partnered with Authorize.net.

Products & Services Offered

Authorize.net has multiple services tailored to merchants. Their two primary packages are the following:

Authorize.Net PAYMENT GATEWAY & MERCHANT ACCOUNT: You can create a combined merchant account and payment gateway with Authorize.net. They will act as your payment gateway and set you up with a third-party partner to act as your processor for your merchant account. There is no setup fee. The monthly gateway fee is $25. Their flat rate per transaction is 2.9% plus $0.30 per transaction.

Authorize.Net PAYMENT GATEWAY ONLY: If you already have a merchant account (this tends to be the cheaper way to sign up with this company), then you can opt for the “payment gateway only” option. There is no setup fee and the gateway fee remains $25 per month. Per transaction through your gateway, you’ll pay $0.10. Your merchant fee is determined by your processor. Per batch, you’ll pay $0.10 as well.

If you’re considering signing up with Authorize.Net for their gateway and merchant services, first speak with Verisave. As Authorize.Net is one of the most widely-used payment gateway systems among merchants in the United States, we have worked with countless companies using their systems. Let us help you to achieve the lowest possible rates and fees, dramatically lowering the cost of merchant services each month.

Concerning credit card payment processing, Authorize.Net offers the following services:

- Merchant account

- Payment gateway

- Authorize.Net mPOS Mobile Payments

- Virtual Point of Sale (VPOS)

- eCheck.Net

- Apple Pay support

- Simple Checkout

- Advanced Fraud Detection Suite (AFDS)

Authorize.Net MERCHANT ACCOUNT: A recommended way to begin services with Authorize.net is by enrolling with your current processor. Using your current processor often results in more favorable rates and pricing. However, if you don’t yet have a merchant account, you can set up your merchant account and payment gateway together with Authorize.net. Merchant account terms and fees will vary based on which third-party provider you sign up with.

Authorize.Net PAYMENT GATEWAY: Anytime you sign up with Authorize.net, no matter which packages you choose, you will have access to their payment gateway services.

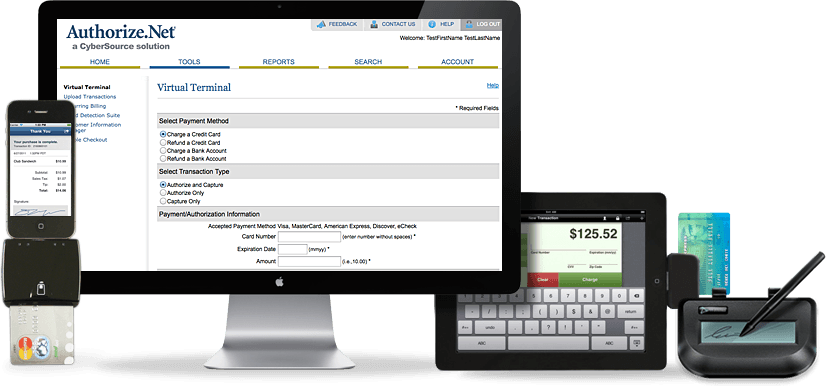

Authorize.Net mPOS Mobile Payments: Use Authorize.net’s mobile app for accepting payments via your mobile device. This can be done via a smartphone, tablet, or plug-in card reader. Mobile payments are accessible on either iOS or Android operating systems. The app is free but should you choose to use a card reader, you’ll have to buy it.

Card Reader Options With Authorize.Net:

IDTech Shuttle Two-Track Secure Magstripe Reader, $50

BBPOS Chipper, $100

Authorize.Net Virtual POS: You can turn your computer into a virtual terminal. Manually input transactions to accept payments. VPOS uses the BBPOS Chipper card reader. This is software is currently only available for Windows.

Authorize.Net eCheck.Net ACCESS: Pay $0.75 per eCheck payment for processing. This feature is optional.

Authorize.Net APPLE PAY SUPPORT: Offer your customers the use of Apple Pay. This is currently only available in the United States using USD currency and other restrictions apply:

- Not usable for in-app payments.

- Only usable by processors that support Visa Token Service and tokenization services from MasterCard and Amex.

Authorize.Net SIMPLE CHECKOUT: Use a number of third-party online shopping carts with Authorize.net. Or, use Simple Checkout with a “Buy Now” or “Donate” button.

Authorize.Net ADVANCED FRAUD DETECTION SUITE: Thirteen customizable filters to customize fraud detection for your business.

UI/System Integration

Though Authorize.Net offers a library of enterprise management tools, their primary focus is their payment gateway system. This system is incredibly easy to use and integrates well with a number of commonly used services including Apply Pay, Paypal, eBay, ChasePaymentech, Visa Checkout, Cybersource, Quickbooks, countless processor companies, and more.

How Much Will You Be Paying For Authorize.Net Services?

PAYMENT GATEWAY & MERCHANT ACCOUNT:

- There is no setup fee.

- The monthly gateway fee is $25.

- Their flat rate per transaction is 2.9% plus $0.30 per transaction.

PAYMENT GATEWAY ONLY:

- There is no setup fee and the gateway fee remains $25 per month.

- Per transaction through your gateway, you’ll pay $0.10.

- Per batch, you’ll pay $0.10 as well.

- Your merchant fee is determined by your processor.

A Few Factors to Consider For Authorize.Net Credit Card Processing Fees

- If a majority of your sales are low-ticket items, the $0.30 per transaction fee will pile up quickly.

- Expect to pay a fee per chargeback. It’s usually $25, non-negotiable.

- International transactions are charged 1.5% for assessment.

- Your processor will also have their own fees on top of Authorize.net’s payment gateway fees.

- eCheck processing is $0.75 for processing.

The rates shared here are accurate if you sign up directly with Authorize.net. If you go through your current processor to obtain Authorize.net services, the rates will vary.

Are you considering using Authorize.net? Speak with Verisave first. Let us help you to work with your current processor in obtaining lower rates and fees for Authorize.net payment gateway service.

If you are currently contracted with Authorize.net, Verisave merchant account experts can still help you to lower credit card processing fees. Submit your most recent merchant account statement for a free analysis. We will comb through it to locate areas of potential savings and let you know how much money you could be saving on merchant account fees by working with Verisave.

Is An Authorize.Net Contract Length Appropriate For Your Business?

Authorize.net advertises no long-term contracts, no start-up fees, and no cancelation fees. This is a great bonus for merchant services as many companies have long-term contracts (2-3 years), start-up fees ($25+), and early termination fees. However, these claims are for their gateway services only. Merchant accounts are subject to the terms of the third-party processor.

- no long-term contracts

- no start-up fees

- no cancelation fees

- Merchant accounts are subject to the terms of the third-party processor

Authorize.Net Sales and Customer Service Reps

You can find a great amount of information, pricing, and customer service/resources on the Authorize.net website. To get more accurate quotes for services, you can fill out a contact form or call the company directly.

Customer service is exceptional at Authorize.Net. They offer a large collection of support documents on the site for all sorts of troubleshooting solutions. If you can’t find what you’re looking for, you can contact their customer support directly via their online chat service or calling them on the phone.

Authorize.Net Online Reviews

Positive Reviews: Generally, customers agree that Authorize.Net offers a wide range of support for varying types and sizes of companies with their customizable packages. Their security and anti-fraud measures are highly reliable. They are also business-friendly, considering they offer month-to-month billing and short-term contracts.

Negative Reviews: Most negative comments about Authorize.net revolve around their customer information portability. After reading through the negative reviews on the BBB, we’ve noticed that the many issues of which customers complained were no longer applicable. The company eliminated their start-up fees and became more transparent about their practices, ridding themselves of the negative feedback obtained in 2016 on the BBB site.

At Verisave, we have had good experiences working with Authorize.Net as we secure lower merchant fees for our clients. Their customer service is easy to access and having worked with them for so many years, we are able to settle disputes and resolve questionable contract agreements with ease to better suit our clients. Their contact information is very transparent and easy to obtain.

Verisave Merchant Services Review

Authorize.Net for Credit Card Payment Processing

Instead of getting wrapped up in a plethora of merchant, accounting, and business management services, Authorize.net focuses on their payment gateway service and has done a great job of working out any kinks or issues since their starting point in 1996. With their gateway services, you also have access to mobile payments, eCheck processing, and excellent fraud protection. Along with their simplified and reliable services, their customer service is also very useful. As a credit card payment gateway provider, we recommend the use of Authorize.net.

Verisave specializes in helping companies reduce their merchant account and credit card processing fees. We find most companies are processing inefficiently – meaning they aren’t maximizing their savings potential. Using our benchmark data and savings strategies, we can increase your processing efficiency, thus maximizing your savings potential.

In most cases, we don’t recommend switching processors. But there will be occasions where you could save more by using a different processor. Once we have reviewed your current merchant account statement, we can let you know if this would be true in your specific case.

We will run your numbers through our database, comparing your merchant fees to 500+ companies that we have worked with, to see if you could be saving more money by working with Verisave. After we determine if your company would benefit from using our savings strategies, we will provide you with our recommendations for potential areas of savings. Once we have signed a working agreement, we will also provide a detailed savings report making our strategies and your potential savings very transparent.

Join the hundreds of companies that have worked with Verisave, lowering their merchant fees and saving thousands of dollars every month in credit card processing. Contact us today to see what Verisave can do for you.

More Services Offered By Authorize.Net

Authorize.Net ENTERPRISE SOLUTIONS: Advertised to companies that process $500,000+ per year in credit card transactions, Authorize.Net provides an enterprise management solution with customizable tools. The pricing varies based on the companies needs. This enterprise management tool provides solutions for the following:

- Fraud Prevention

- Manage Customer Information

- Automated Recurring Billings

- Check Processing

- Quickbooks Syncing

- Invoicing

- Automatic Account Updates

- Simple Checkout for Customers

Authorize.Net AUTOMATED RECURRING BILLING: Offer customers a free trial period or paying for services/goods in installments.

Authorize.Net CUSTOMER INFORMATION MANAGER: This is a standard feature offered by Authorize.net. It is secure storage for customer personal info (billing/shipping address’ and payment information).

A major complaint customers have had concerning Authorize.net is the customer information portability. Should you decide to switch systems and stop using Authorize.net as your payment gateway, transferring client information is no simple task. Plan on either manually entering individual client info into the new system to transfer, or wait up to 8 weeks for Authorize.net to transfer your data. Authorize.net explains the reason for this time-consuming task, “Because this includes your customers’ sensitive credit card information, the data is securely encrypted. As we’ve noted, however, this security comes at the expense of data portability.”

Authorize.Net SYNC FOR QUICKBOOKS: If your company is still using Quickbooks, Authorize.net syncs well with this system for easy data transfer.