Merchants pay fees for each sale that is made using a debit or credit card. Though it may be a small percentage, the numbers can really add up over the course of a year. Let’s go through a basic rundown of the numbers.

Average credit card processing cost for merchants:

If the card is swiped:

2.45%-3.25%

If the card is not present

2.75%-3.75%

Keep in mind that these interchange rates are determined by a number of factors so these numbers can vary depending on each individual transaction.

At these rates, a business that processes an average of $500,000 a month in sales can expect to pay $12,250 – $16,250 monthly/ $147,000-$195,000 a year in credit card processing fees.

Monthly CC Volume: $500,000

x2.85%

Ave. Monthly Fee: $14,250

Ave. Yearly Fee: $171,000

Consider another company processing an average of $1,000,000 each month in sales via credit card transactions. This company will expect to pay an average of $28,500 each month or $342,000 every year in credit card processing fees.

Monthly CC Volume: $1,000,000

x2.85%

Ave. Monthly Fee: $28,500

Ave. Yearly Fee: $342,400

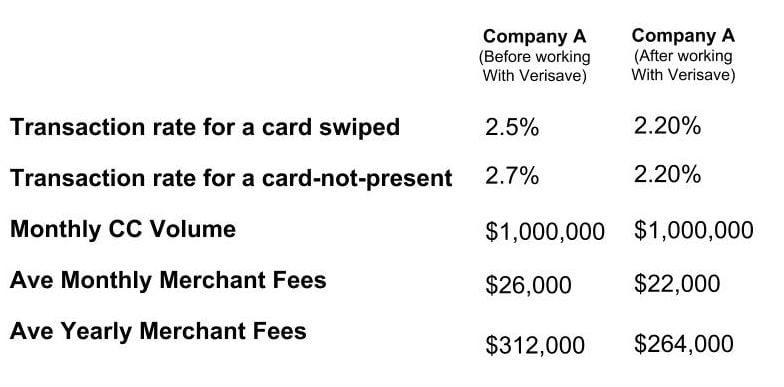

As you can see from the above rates, the actual amount that companies pay in credit card fees varies. If you are stuck paying higher than average rates (which many companies are), we can help you lower your credit card processing rates. In some cases, even a small change in the percentage can have a huge impact on your bottom line. Compare the difference in rates below:

Verisave Cuts Spending For Merchants In A Number of WaysThe difference a small jump in percentage makes for your credit card processing fees can mean the difference of thousands of dollars every month in spending. Imagine uncovering a savings of nearly $50,000 a year! With Verisave, you can expect to pay the lowest possible transaction rate for your merchant services. Thanks to years of experience and a detailed knowledge of the back end cost structure of the credit card industry the Verisave team can increase your company’s bottom line by eliminating and reducing your credit card fees.

At Verisave, we focus on three main aspects of your merchant account for cutting costs: Interchange Savings, American Express Savings, and Processor Savings. Significantly lowering your merchant fees requires lots of time, education, and testing. We have worked with every payment platform out there and a number of processing companies. This experience has been invaluable to our team of auditors. In about 2 business days, we can review your merchant statement and locate a number of itemized fees that can be either eliminated or lowered. Many of these fees are hidden between convoluted lines of itemized billing.

Send us a copy of your statement and at no charge to you, we will comb over the details to determine exactly what your company could be pocketing each month. Not only can we return a detailed summary of our findings in only a few days, you could be realizing these savings in just a matter of weeks. Call us today and let us show you what we can do for you.